** I am introducing a new arbitrage sector trading model below the usual content

A lot has transpired over the past couple of weeks and we may be at a period of time that finding really attractive risk:reward trades might be difficult, given that some markets may encounter a consolidation phase.

Fed

It appears that the Fed is at terminal, but we should be careful not to assume that there is certainty over the next easing cycle.

We have heard from several Fed officials, including Chair Powell, that they do not know for sure if another rate increase is required but they continue to be concerned that inflation could flare up again. For example, Kashkari, Minneapolis Fed president stated that he is worried that inflation is ticking up again and that under-tightening will not result in reaching the 2% target.

I discussed this perhaps a year ago - the Fed moves during the 1970s were a mistake (cutting too soon), with Powell stating many times that they will not make the same mistakes. I have continued to err on the side of a Fed willing to be tighter than expected, unless inflation moves down substantially (more on the Fed below).

Jobs Data

The latest report indicated “good” news (for Fed watchers) in the economy is not re-accelerating. The unemployment rate ticked higher and jobs created came in below consensus, at 150k. Also note that the prior two months were revised lower (in total, by 101k).

One thing to watch is where the data comes in versus expectations. If you were to look at the period prior to the 2008-2009 GFC, yes job creation was slowing, but also for quite a period of time the actual number was lower than consensus. More recently, since February 2022, the actual number was higher than consensus. People were too optimistic about the economy going into 2008 GFC, and people were too pessimistic about the economy for the past year. Consistent misses (positive or negative) versus consensus informs us of where the public views the economy.

In May of 2023 the unemployment rate hit 3.4%, we are now at 50bps higher from this point. I would be very cautious about calling for a reversal in the unemployment rate - that is to say, analysts calling for a strong 2024 economy are doing so in the face of a weakening labor economy. In the past, once we crossed this 50bps point higher from the relative low, the unemployment rate just accelerated even further. I have always had confidence that the Fed can slow the economy, I have little to no confidence they can stop the increase in the unemployment rate before it moves substantially higher.

This, to me, increase in the unemployment rate along with continued tighter monetary policy indicates a higher than normal probability that the economy will enter into an economic slowdown in Q1-Q2 of next year. While I have been expecting a slowdown at some point, I have also cautioned about being too early and waiting for the data to show that finally the economy is turning.

This coincides with prior reports that I included research indicating that the post-pandemic savings are being spent such that consumers would be reaching their exhaustion point in late 2023. We are seeing credit card utilization increase and savings are being depleted. Again, calling for an economic re-acceleration (outside of inventory buildup, that is not sustainable) is at odds with the underlying fundamental change of consumer’s financial position.

While the jobs data may bounce around over the next month, given required help for the holidays, I think in Q1 2024 we may see an acceleration in the decline in the jobs market.

The market so far is viewing “bad” economic news as “good” news for stocks. For now, this makes sense. Milder economic growth and signs that inflation is abating will keep the Fed at pause, even as companies are reporting relatively strong earnings results (so far). We are in a sweet spot - for now. However, as monetary tightening policies weigh down on the economy, companies will increasingly struggle to increase revenue and profits, this is when they will start to guide down forecasts and analysts will have to adjust their prognostications.

Earnings Season

92% of S&P 500 companies have reported earnings results so far for Q3, with 61% reporting a positive revenue surprise. The blended rate y/y is 4.1%, with the forward P/E ratio of 18.0.

Analysts have pushed out stronger growth expectation, as Q4 projections are for earnings growth of 3.2% versus 8% in September. I was not supportive of such an optimistic forecast back then and analysts did eventually lower their numbers, but what they did to justify current equity valuations is that they pushed up future quarters, with Q1 2024 growth at 6.7% and Q2 2024 growth of 10.5%.

Analysts believe that 2024 will start strong and continue to accelerate throughout 2024. Sectors that are leading this growth includes consumer discretionary. Full year expectations for 2024 are at 11.6%, which is slightly lower than 12.2% reported at the end of September but quite lofty in my opinion.

The economy has remained resilient far longer than I (and many others) expected, with the help of pandemic savings. This shows in the current earnings reports. However, as I just outlined, to expect an even strong re-acceleration in Q1 and Q2 2024 seems incongruent with some of the underlying economic factors. We are now seeing the unemployment rate tick higher, monetary policy remains restrictive, leading indicators are still flashing red and yet analysts are putting their foot to the ground on the accelerator and forecasting a very strong 2024. Given that the forward P/E for the S&P 500 is not cheap, at 18x, this is a pretty risky bet.

For the remainder of 2023, we could very well have a year-end rally. Companies have reported, so no reason for them to start warning yet prior to year-end. Consumers still have jobs (for the most part) and there may yet be still some savings to be run down, along with increased credit card usage. However, 2024 may bring a hangover with this spending binge that could result in more than just a headache.

Who is Right?

There is a tug-of-war going on right now. If you were to look at probabilities for Fed cuts, the market is pricing in only a 33% probability that the Fed funds rate will remain at current levels in June 2024, with 41.3% of a 25bps cut and 16.6% of a 50bps lower rate at that point.

However, as just outlined, the economy is expected to re-accelerate by equity analysts in the first half of 2024.

Under what circumstances would the Fed start cutting? If inflation were to decrease towards target of 2% and/or the economy slows substantially (or some combination). Even the Fed does not believe that inflation will be close to target by June. I know that Fed officials have stated that they do not need inflation to be exactly at 2% to start cutting, but inflation would have to be pretty close to target.

That is to say, those betting on strong economic growth think that inflationary pressures will drop substantially over the next few months. How will profit margins be maintained, or even grow, under that scenario? (to support equity valuations) We have already seen research from the Fed that margins are under pressure, which is good from an inflation point of view, but if businesses can’t pass on price increases (to ensure inflation drops, as part of the narrative), equity analysts would then have to expect strong revenue growth. Again, in the face of tighter monetary conditions and savings depleted, that seems like a risky bet.

If you just look at the history of Fed cuts, most were surrounding a recession. The period during the 1990s was the exception, with the Fed cutting and the U.S. economy did not enter a recession. However, while many people like to compare this period to the 1990s, I always like to add that inflation was far more stable (and lower) during that time period.

Could this narrative occur, inflation drops substantially resulting in small Fed cuts with the U.S. economy accelerating in 2024? While possible, the historical occurrences suggests this would be a low probability outcome.

Moody’s Cuts U.S. Credit Outlook

I am sure you have read the headlines, so I won’t spend much time on this topic. Moody’s cut the U.S. credit rating from stable to negative. The concerns are not new, large fiscal deficit and rising interest costs.

The political situation, according to Moody’s, increases the risk that future governments will not be able to “reach consensus on a fiscal plan to slow the decline in debt affordability.”

To be clear, Moody’s still has an Aaa rating, as opposed to Fitch that cut the U.S. government rating.

This is a long-term story here, even though there are short-term headwinds such as the potential for a government shutdown on November 17th. For the time being, the U.S. still remains the best place to park cash - full stop. If you are a large corporation or government, where would you park a few billion? Europe? China? While Europe may appear an option, their fixed income markets are still too small. Frankly, the size of the U.S. fixed income market and the fact that the economy is still incredibly strong creates an attractive place to park cash. However, these long-term concerns are very real and need to be handled before things get out of hand (some may say we have moved past that point, still to be determined).

Bottom-line, I do think the additional supply has affected yields, but this downgrade will not be the impetus for a trade (for me).

What to Watch this Week

Biden - Xi meeting will be important. It seems that views regarding China are very low, therefore there may be an opportunity for a risk-on trade if there is any positive news (even if minor). Reports I have read indicated that “experts have low expectations”. This creates the potential to surprise, even if a relatively low probability of occurring.

CPI, expectations are for headline at 0.1% m/m and core 0.3% m/m. Any deviation from consensus would materially affect markets (especially if there is a number too hot).

Retail sales, expectations are for a decline by -0.3% m/m. A view into the mind of the consumer. I think the situation between pandemic savings and credit card usage may still result in additional pent-up spending demand. 2024 may be a different story, once this year ends.

Equities

As I wrote in the last report, “I will be looking on Monday and/or Tuesday to put on a very short-term options trade, expiring by the end of the week to capture this potential rebound, while also permitted me to hedge my short exposure” and related to my longer term short from 4500 region, “If the SPX moves above 4285, I would close my short entirely and re-evaluate.”

This is exactly what happened, Monday October 30th and Tuesday October 31st I put on option trades that were bullish of the S&P 500, and I did close out my short as the S&P 500 moved through my stop.

So where are we now?

As I briefly noted earlier, I think the Biden-Xi meeting may end up being not negative (ie. potentially positive, but probably not a disaster), and we are through earnings season that was not terrible along with a benign jobs report and quite possibly tame inflation data (tbd this week). There is also the potential for a technical year-end rally, as funds with cash on the sidelines look to put it to work, afraid of missing out returns versus their competition and underperforming. The longer markets remain stable, with a VIX that does not spike, and gently move higher, this creates more interest in buyers who are afraid of missing out any year-end rally.

As a result, I am leaning bullish in the short-term. Weakness could come in early 2024 (perhaps Feb) as companies assess the holiday season and start to adjust payrolls (ie. potential for much lower jobs data, higher unemployment) and firms start to warn for the next earnings season. Speculation on my part, but this is one path that I think has a fairly high probability of occurring, unless a black swan event occurs (war, weather and so forth).

I am interested in putting on a long position in the 4370-4400 area, small position at first. The market has moved up quite a lot and some back-and-forth is likely. A breakdown through 4310 would invalidate my long (ie. region for a stop level) and I would add a little over the coming days and perhaps even weeks if the market indicates that buyers are taking control. Initial partial profit target is in the area of 4530 and if it gets through that point, 4600.

Fixed Income

This is the 2 year yield, along with Fed funds rate (black) and vertical red lines indicating when the Fed hit terminal in the past.

As I wrote in the last report, “If the Fed is at terminal, I would be interested in starting to consider buying the 2 year. Now, for a very large move higher in price (down in yield), it would have to follow that the Fed would need to cut substantially. As outlined above, the economic data does not indicate that such is a possibility yet. Therefore, I will still wait but may nibble at opportunistic trades here and there.”

The 2 year yield move down quickly towards 4.80 before moving above 5%. I was quite surprised by the move down in yields, it did not make sense to me. As I wrote before, a large move down in the 2 year only works if the Fed is about to start a substantial cutting cycle. I do not believe they are about to do so anytime soon. As such, I will not put on a large position but may trade around on the edges. For example, a 2 year yield at or above 5.15% looks attractive. I do think the risk:reward is very attractive at yields above 5% as I think the economy may enter a contraction in 2024 resulting in Fed cuts. We may have to wait a few months, but once data appears to indicate that the economy is slowing, traders will jump in heavy into the 2 year. At that point, with data indicating the economy has turned (one could argue the jobs report this month was the first “tell”), the risk:reward is very attractive for the 2 year, in my opinion.

The longer end is a bit more complicated as one has to factor in long-term economic growth/inflation and issuance levels. I wrote in the last report about the 10 year, “The key difference today is that note in the past, momentum has started moving higher as the Fed hit terminal, while current momentum is moving down.” What is interesting is that the move higher in price was so strong that momentum has begun to shift. I am not yet ready to jump in the 10 year, but am watching closely. The thing to remember, a lot of funds were short and forced to cover. That buying binge/short covering rally is over, so now I want to see what the real long-term money is thinking. If we see consolidation and additional increase in momentum to the upside (in price), I would be interested in stepping in as well.

Oil/WTI

No change from the last report, as I wrote “What will I do now in the oil market? Nothing. Given the situation in Israel, and the fact that WTI has dropped right in the middle of a wide trading range, there is no attractive risk:reward trade. I will sit on the sidelines for now in this market.”

I would be interested if price moved to extremely low levels, but it has not. Current price is right in the middle of a long-term range, so no reason to think that I know more than the market - therefore, I will remain on the sidelines.

Gold

I wrote last time, “I would want to see a move above 2010-2015…” It did not close through those levels and as such I remained on the sidelines. Currently gold is in the middle of a wide trading range. I have no edge at this point and no attractive risk:reward trade. I am quite a bit surprised that given the geopolitical tensions gold has not risen further. Perhaps that is what other traders are thinking as well and selling their holdings as the price has failed to move substantially higher.

New Quantitative Trading Models

I have been working on several models to help further diversify my personal investments in a range of

assets (stocks, fixed income, commodities),

timeframes (short, medium and long-term),

strategies (discretionary, market-neutral arbitrage, long/short, trend following/reversion and so forth).

In addition to the discretionary, macro trades I have been discussing, I will introduce in this report a market-neutral hedged strategy using the S&P 500 sectors. The idea is, theoretically quite simple, buy the sector that is showing signs of strength and short the sector that is showing signs of weakness. The details are quite difficult to code, but I am sufficiently confident that my model is robust to put my own money to work. I do run other models, but those are very short-term (ie. daily) and this frequency would not work well in this (Substack) format. As such, this model can take on a position and hold it for potentially a very long period of time. I will also use this information to trade around a position. For example, if a spread is favorable for one sector over another, short-term pullbacks may be opportunistic entry/exit points.

For entry Monday morning:

The idea is to be long one sector and short another.

There are two trades I am making myself - to be clear, I am NOT suggesting or recommending that any reader make the same trades. This is for entertainment purposes only! Also, any indication of shares traded or price are for illustration purposes and are NOT recommendations to buy or sell anything.

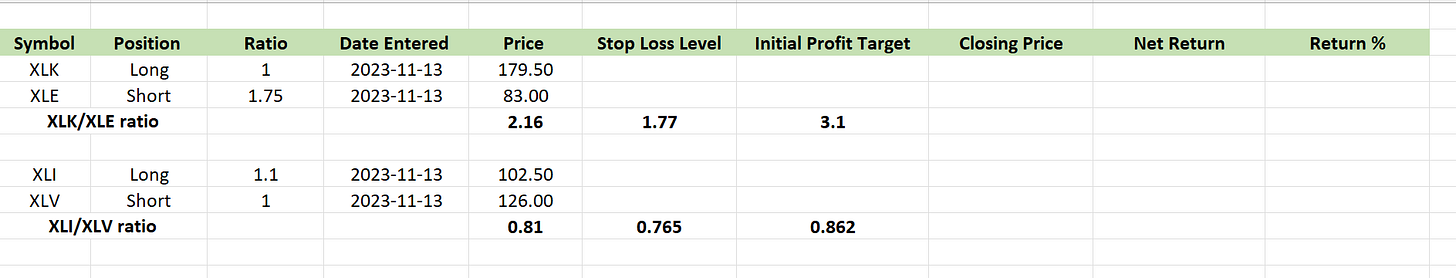

First trade, I am going long XLK and short XLE, with the ratio of 1.75 XLE for every 1 share of XLK. The price ratio on entry is to be more than 2.16, with a target of the ratio to hit (for partial profits) 3.1 and a stop loss of 1.77 in the ratio.

The second trade I intend to go long XLI and short XLV, ration of 1.1 share XLI : 1 XLV share, with price ratio of no more than 0.81, initial partial profit at 0.862 and stop loss of 0.765.

Here are charts to better illustrate:

XLK/XLE:

XLI/XLV:

I will also be introducing a quantitative model in futures market that will include agricultural commodities, energies, metals, softs and so on. The idea is to better diversify my portfolio, as many commodities move independently of economic related fundamentals.

Thanks for reading!

theglobalmacrotrader@gmail.com

Twitter —> @TheGlobalMacro

Disclaimer

Copyright (c) TheGlobalMacroTrader.com 2023. All rights reserved. All material presented either through the TheGlobalMacroTrader.com website, Substack, any newsletter published by this site, posts on any social media platform and other public comments are not to be regarded as investment advice, but for general informational and entertainment purposes only. You, the reader, assume the entire cost and risk of any trading you choose to undertake. You, the reader, are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer. The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice and are for entertainment purposes only, no advice has been presented and no recommendation have been made. All information on TheGlobalMacroTrader.com, and any associated pages such as the SubStack pages, are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings along with discussion over chart formations and quantitative metrics may be mentioned but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security—including commodities, currencies, stocks, bonds, exchange traded funds (ETF), exchange traded notes (ETN), mutual funds, futures contracts, or any similar instruments. All text, images, ideas and concepts on TheGlobalMacroTrader.com and associated websites, emails, posts and social media messages constitute valuable intellectual property. No material from any part of TheGlobalMacroTrader.com and associated websites, emails, posts and messages may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of TheGlobalMacroTrader.com. All unauthorized reproduction or other use of material from TheGlobalMacroTrader.com and associated websites, pages and emails shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. The recipient should check any email and any attachments for the presence of viruses. TheGlobalMacroTrader.com accepts no liability for any damage caused by any virus transmitted by this company’s website, emails, attachments, posts and any other method of communication. TheGlobalMacroTrader.com expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. TheGlobalMacroTrader.com reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Very interesting this week!