Fed Pushes Back Against Cuts, Is there a Trading Opportunity?

I have kept writing that the probability of a Fed cut in March was unrealistically high, including the not so subtle title of a prior post back on January 7th 2024, “Why March Fed Cuts are Unlikely and Caution to Bullish Fixed Income Traders.” (post located here).

Markets are finally coming around to my line of thinking, with the March probability being now essentially a coin flip.

Fed officials have been out last week with that narrative, pushing back against cuts starting so soon and the overall number of cuts. This is prior to their blackout period ahead of the next FOMC meeting coming up in nine days.

The market is definitely more realistic now, but I suspect there will be more pushback by Fed officials, not less. As I have discussed before, and won’t waste your time by going back over prior posts, the economy is not falling off a cliff. Unemployment is still near the lows. Weekly claims last week came in far below expectations. Finally, the Fed has stated their concern that inflation may flare up again (at least some Fed officials have been worried about this possibility). Against this backdrop, I see no reason for the Fed to cut in March.

San Francisco President Mary Daly stated that it is premature that Fed cuts are around the corner. Daly, along with many other Fed officials, stated that she needs to see further evidence that inflation is headed towards their 2% target. Daly remarked, “Do I get consistent evidence that inflation is coming down, or do I get any early signs with the labor market starting to falter? Neither one of those right now is pushing me to think that an adjustment is necessary.” Note that Daly is a voter this year.

Fed Governor Christopher Waller was a big driver in markets this past week, indicating that cuts this cycle will be slower than in the past. (speech located here) In this speech, Waller gave some interesting insights as to what he is watching, such as (emphasis mine):

“One piece of data I will be watching closely is the scheduled revisions to CPI inflation due next month. Recall that a year ago, when it looked like inflation was coming down quickly, the annual update to the seasonal factors erased those gains. In mid-February, we will get the January CPI report and revisions for 2023, potentially changing the picture on inflation. My hope is that the revisions confirm the progress we have seen, but good policy is based on data and not hope.”

“PCE inflation of 2 percent is our goal, but that goal cannot be achieved for just a moment in time. It must be sustained at a level of 2 percent…I think we are close, but I will need more information in the coming months confirming or (conceivably) challenging the notion that inflation is moving down sustainably toward our inflation goal.”

“When the time is right to begin lowering rates, I believe it can and should be lowered methodically and carefully. In many previous cycles, which began after shocks to the economy either threatened or caused a recession, the FOMC cut rates reactively and did so quickly and often by large amounts. This cycle, however, with economic activity and labor markets in good shape and inflation coming down gradually to 2 percent, I see no reason to move as quickly or cut as rapidly as in the past. The healthy state of the economy provides the flexibility to lower the (nominal) policy rate to keep the real policy rate at an appropriate level of tightness. But I will end by repeating that the timing and number of rate cuts will be driven by the incoming data.”

The Fed is being cautious and does not want to jump too far and end up looking silly by having to reverse course and hike once again. This is my view, but so far all the evidence suggests this is how they are thinking about monetary policy this year.

Atlanta Federal Reserve President Raphael Bostic, one who is concerned about the labor market weakening, stated that he too shares concerns over a possible re-acceleration (speech located here):

“Because I'm data dependent, I have incorporated the unexpected progress on inflation and economic activity into my outlook, and thus moved up my projected time to begin normalizing the federal funds rate to the third quarter of this year from the fourth quarter.

Let me list a few metrics that will be of particular interest to me in assessing the appropriate path for policy in coming months.

I will be looking at shorter-term inflation measures for clues to where the 12-month inflation readings are likely headed. As the chart shows, the six-month and three-month change in the PCE inflation gauge, respectively, were right at and a bit below the 2 percent target as of November (chart 2). I will look for continued good news there….

Should underlying economic momentum prove stronger than expected and spark inflationary pressure, the Committee may need to maintain the restrictive policy stance longer than I foresee. Relatedly, premature rate cuts could unleash a surge in demand that could initiate upward pressure on prices.

Even after incorporating the recent softness in the underlying inflation data, my baseline forecast for full-year core PCE inflation is still 2.4 percent. That said, if we continue to see a further accumulation of downside surprises in the data, it's possible for me to get comfortable enough to advocate normalization sooner than the third quarter. But the evidence would need to be convincing.”

Do any of these statements indicate that the Fed is about to rush to cut rates? Not to me it does not, unless that data over the next few months comes in significantly below expectations. That is yet to be determined.

Thoughts on Long Duration Assets

The narrative now being disseminated by Fed officials is that they may hold-off on rate cuts for a little while longer. While this had the natural reaction on the front-end of the curve with a backup in yields, the longer end of the curve also increased in yields.

I think that perhaps this is a mispricing and potential opportunity, if I am correct. If the increase in yields is related to elevated concerns over inflation, higher yields make sense. Perhaps there is also concern over the supply of debt, with the potential of a continuation of elevated debt supply post-election, again higher yields make sense.

However, if the concern is related primarily over the Fed keeping rates at current levels for a little while longer, I would take the other side of that trade.

Why?

What happens if the Fed remains restrictive for longer? It further squeezes the economy and helps slow it down. I think this is occurring now and will continue to slow the economy in 2024.

A slow economy would be bullish for longer duration fixed income, but negative for equities (especially the no earnings, sky-high valuations stocks).

Can inflation flare up again? Quite possibly yes, especially as we are seeing shipping rates increase. Supply chain issues are becoming a worry once again. Hourly wages still remain strong. Fiscal policy is still contributing a significant amount to GDP. These are all good reasons for the Fed to remain restrictive for longer.

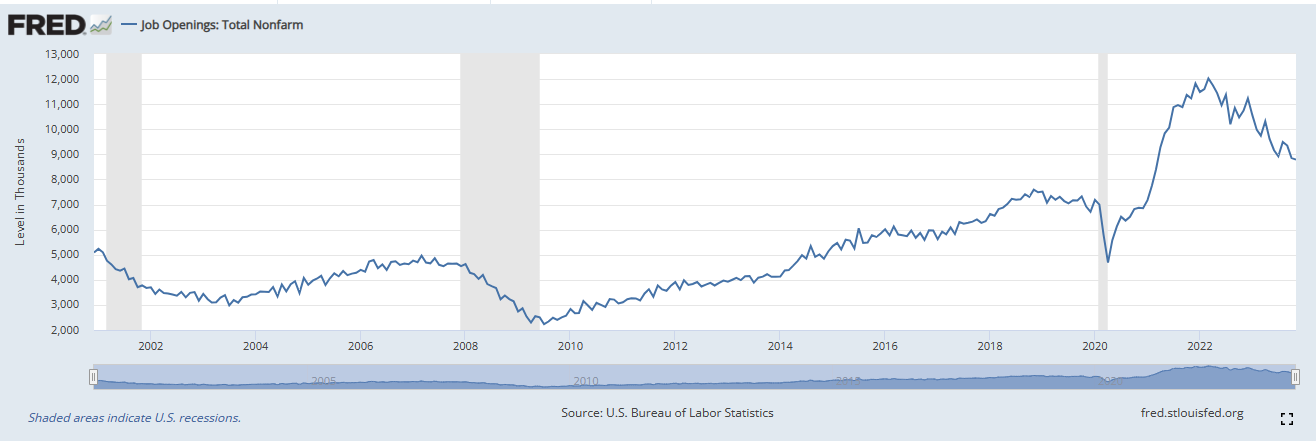

However, we are also seeing signs that the economy is slowing. Before companies begin to fire people on a larger scale, they post fewer job openings. What are we seeing now? Few job openings:

Total Nonfarm Job Openings

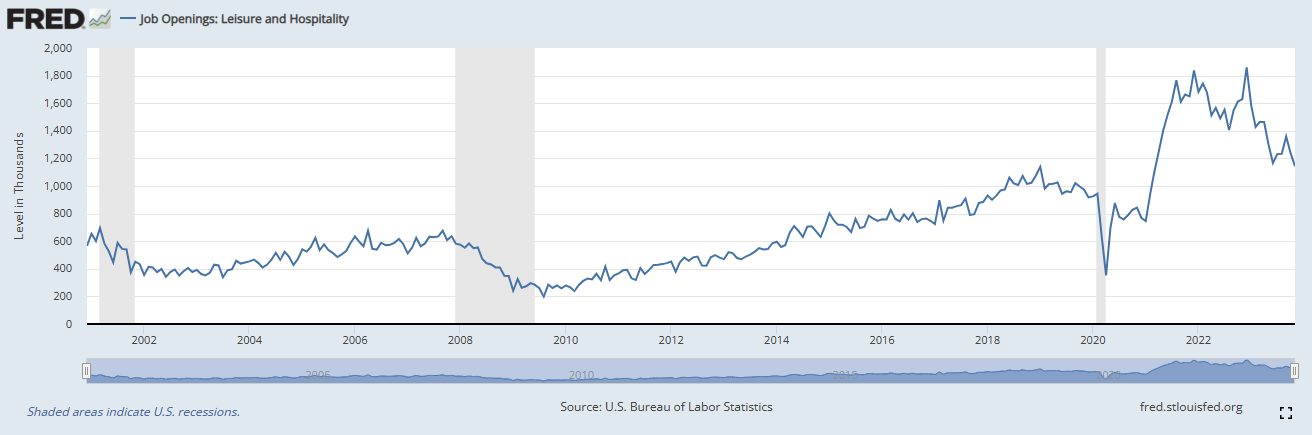

Ah yes you might say, but 1) the overall level is higher than pre-covid and 2) the strength has been in leisure and hospitality. While the overall numbers in aggregate still look strong, albeit on a downtrends, is the strength still present in leisure and hospitality, what do those job openings look like?

Job Openings Leisure and Hospitality

The current level is approximately the same point as January 2019, which was still strong at that time. However we are seeing a significant decline in job postings in this sector and until we see a reversal, I think this may continue as tighter monetary policy continues to slow the economy.

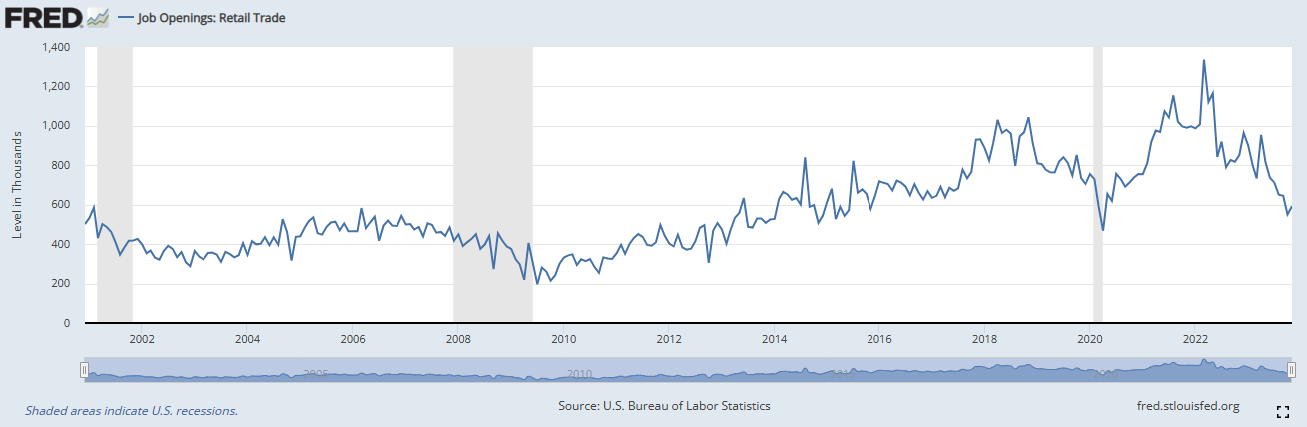

Remember that recently strong retails sales number? Interesting as job openings are far below pre-pandemic levels. I do realize that a lot of retail sales has moved online, but the trend remains intact in that it is downward sloping.

Job Openings Retail Trade

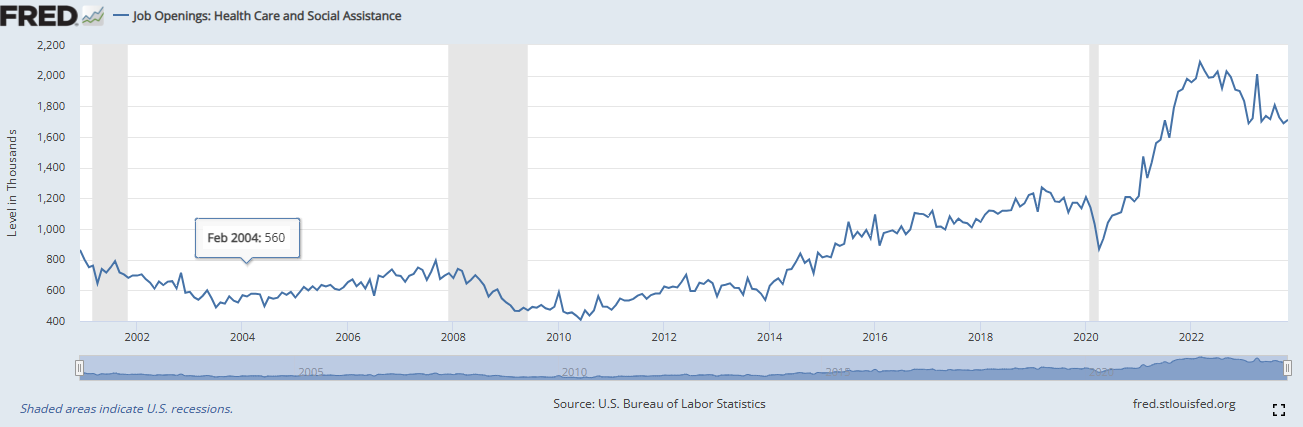

Are there areas of strength in job openings that are holding up the aggregate number? Yes, these are primarily government and health care & social assistance. Interesting that those two sectors are not as affected by tighter monetary policy.

Job Openings Health Care and Social Assistance

While some recent economic data points indicate strength, such as retail sales, I think they might be the last hurrah by consumers as the economy continues to slow. The next leg in the economy will be important and driven by the Fed, if they cut soon and by a large amount then a rebound is likely, if not then a continued slower pace into potentially an outright economic contraction later in 2024 in quite possible.

Data Last Week

Retail sales came in hot, no question. Is there more room for the consumer to spend in 2024 or have they cashed out their post-covid savings as credit card debt continues to climb? As long as unemployment stays low, I would not expect a massive drop-off in retail sales, but I do think there is a reasonably high probability that unemployment will rise this year.

Weekly unemployment claims were 187k, far below the 206k expected. As I have been writing about the last few weeks, the holiday season is an odd period to extrapolate trends for 2024. Firms generally do not fire people ahead of this busy season. If they start to adjust their workforce in Q1-Q2, then we will have a better idea of what firms see on the ground.

UoM consumer sentiment soared 13% in January, the highest level now since July 2021. Consumers seem to be of the view that inflation has finally turned lower. Interesting that the two month move in December and January was the highest such move since 1991, as the recession at that point was ending. A big driver was that the number of people expecting interest rates to drop surged.

This is something to think about in terms of a re-acceleration. If the Fed does cut with the economy doing relatively well, this would add significant fuel to really flare up economic growth, and then eventually inflation. If the Fed does cut soon and the economy is holding up well, we could be in for a really strong year! However, I think the Fed is watching these trends too and is not oblivious to what may happen. Under that belief, my base case is that they stand pat for some period of time to wring out the last vestiges of inflationary pressures, but this will come at a cost to economic growth later in 2024.

Earnings Season

Obviously earnings season will be important over the next few weeks, not for what companies will report but how they guide for 2024. It seems with the strong retail sales data, firms may not be so quick to guide down. In that case, there may be little reason for equity bulls to adjust their position and tailwinds to continue drifting stocks higher, at least for now.

The AI story still appears to be quite strong, not sure if we will get any headwinds in that direction either.

Data to Watch This Week

The big data point will be on Friday with the Fed's preferred inflation measure core PCE. As PPI is an input in this data point, and that came in below expectations, if anything I would err on the side of an ever so slightly cooler number than the expected 0.2% m/m.

Friday also has personal income and spending data, interesting to see if people are dipping into their wealth to spend.

Weekly unemployment claims will be interesting to see after a really strong print last week. Expectations are for 199k.

Advanced GDP expected at 2.0% q/q after a strong 4.9% print the prior quarter.

PMI data with expectations of a continued contraction in manufacturing but services remaining in expansionary mode, albeit slowing down towards the key 50 level. Global PMIs will also be out, interesting to see where the rest of the world is in terms of growth.

A lot of central banks will be out this week including the European Central Bank, Bank of Canada, Bank of Japan, Central Bank of Norway along with Malaysia and Turkey.

Equities

Quick recap, I am still long about a quarter of my position from the 4400 area, taking profits along the way (last week I outlined those profit target levels).

As I wrote last week, I did move up stops to the 4710-4715 area. I thought they might get triggered on Wednesday but did not, as the S&P 500 was below 4715 for under one minute - that is not enough for me to start selling. I use these ranges in combination with how the market acts. What happened at that point was that buyers emerged and continued to step in on any pullback. By Friday, it was obvious that the market was not pulling back. When you see a strong rebound during the week on a Friday, along with a major option expiration day, I always watch how the market acts in the middle of the day. There was a pause midday, but then around 12:30 stocks broke out to the highs and at that point there was very little that would stop the move higher.

Where to now? Unless earnings guidance comes in weak or economic data is drastically different (both obvious points), I think still higher. I will just trail my stops and not have any further targets. Now moved up and spread out a little more, in the 4715-4735 range. I do think we will get to a point in 2024 where the call will be to go short stocks, but clearly not yet.

Fixed Income

This is the 10 year yield going back to 1985, along with the Fed funds rate (black) and vertical red lines indicating when the Fed hit terminal for that rate rising cycle.

I wrote last week, “At this point, I am hesitant to go long, as I do not see the drivers for a substantial drop in yields down towards the 3.70% area. I would be more interested in waiting to see if there is a backup in yields towards the 4.08%-4.10% region where I think there will be support.”

Of course hindsight being 20/20, I now wished I went short as yields moved up approximately 19 basis points during the week. Naturally I, nor anyone, can see the future so clearly as to call exact tops and bottoms. I try to be on the “right side”, with tailwinds rather than fight headwinds.

I do think there is value in looking for fixed income longs among the pullbacks that we are going to see in fixed income this year. I talked about that at the beginning of this year. We will see various data points that stray from consensus, along with Fed speakers and so on, that will create a lot of oscillations and therefore trading opportunities.

I wanted to quickly show the long-term history of the 10 year yield. As I discussed earlier, if the Fed is willing to be more patient and leave rates in restrictive territory for an extended period of time (ie. pause and leave higher for longer), this increases the attractiveness of longer duration yields as it increases the probability of an economic contraction. Yes, there will be oscillations along the way, notice that while the Fed paused in the summer of 2006, the 10 year did move back towards the highs in the summer of 2007 before falling sharply.

The question I would ask someone selling here is why? Is it that they are worried about 1) increased supply, 2) increased inflation and/or 3) re-acceleration of the economy? Possibly all three? If so, then I would agree with the call that yields would most likely go higher. I would definitely agree with that call if the Fed started to cut soon, and rather aggressively. That would be a combination that would be adding fuel to the fire that is just about to go out, stoking the remaining embers to yet a new flame and resulting in a trade for (over the short-term) long equities and short long duration fixed income. That would be a very attractive trade set-up.

So far, I have not seen sufficient evidence for that scenario. Fed officials have been pushing back on the early Fed cuts, and overall number of cuts. Inflation data was a bit stronger (in my opinion) than the market thinks, but still moving in the right direction (ie. lower). Finally, there are signs that the economy is starting to slow. If the Fed keeps current restrictive monetary policy for a little while longer, as I suspect, this should help pressure the economy to slow down even further. This, to me, is a tailwind that I like to be part of, not fighting the Fed.

As the chart indicates, there is no magic timing here, markets move back and forth, so I will be cautious and enter longs at opportunistic points and trim when they move too far in the other direction.

This is the daily 10 year yield with some levels I think are important to watch. 2024 may be the year of 4% being the key figure with oscillations of +-25bps, perhaps even more than that under certain circumstances. I did enter a long position last week on the move higher in yields in the 4.10-4.15% range. I will wait and see how the data looks this week, but am inclined to add more if yields stabilize and start to head lower going into Friday’s key core PCE data point. I think there is a reasonable probability of that number being lower than expected. I would take some partial profits in the 3.70-3.80% region.

Regarding the 2 year, I wrote last week, “Typically large momentum fades, as it can only be sustained for so long. The question is, how many traders are going to keep piling into the 2 year at this point? I don’t know, but I will sit on the sidelines and wait it out. I would not go short either. We might get some Fed speakers next week that could push back on the move in yields and pricing of Fed cuts, that would cause some traders to question their positioning and take some profits (ie resulting in a backup in yields).”

Again, I should have been more aggressive and shorted the 2 year, but some of the moves have been extremely violent and I would prefer to trade with longer-term tailwinds supporting me. This part of the curve is trickier as I think the market is still too aggressive with Fed cuts and as such I will continue to sit on the sidelines. However, if I am right and the Fed does stand pat, it further supports the 10 year, as noted earlier.

Oil

Nothing has changed from last week, which I wrote “This is not a chart I like at all, it is full of battles between the bulls and bears. There is no edge for me as neither option (long/short) offers an attractive risk:reward setup and rumors about war tensions will push prices all over the place. I remain on the sidelines.”

Gold

This is the daily chart of gold. From the lows in October, gold moved higher, then in December it fell through it’s upward sloping support line and tried again to move to the highs, which it failed. It appears ready to roll over and as such I am inclined to put on a short but not until gold breaks 2005-2008 level (this is the continuous contract). If PCE comes in lower than expected, gold may get another bullish impulse, but if not it may fall through the 2005 area and head towards the 1935 region and then test 1900. If I do open the position, I would initiate with stops in the 2050 region and move them down if gold moves lower.

This is not a high conviction call, and I would prefer to enter a small position and add along the way down. I think this would also be a partial hedge to my fixed income position. If PCE does come in significantly below expectations, my long 10 year should move lower in yield/higher in price, but gold would move against me. However, if PCE comes in hotter, gold should move down supporting this short position while yields would backup.

Thanks for reading!

theglobalmacrotrader@gmail.com

Twitter —> @TheGlobalMacro

Disclaimer

Copyright (c) TheGlobalMacroTrader.com 2024. All rights reserved. All material presented either through the TheGlobalMacroTrader.com website, Substack, any newsletter published by this site, posts on any social media platform and other public comments are not to be regarded as investment advice, but for general informational and entertainment purposes only. You, the reader, assume the entire cost and risk of any trading you choose to undertake. You, the reader, are solely responsible for making your own investment decisions. Owners of this newsletter, its representatives, its principals, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission or with any securities regulatory authority. We recommend consulting with a registered investment advisor, broker-dealer, and/or financial advisor. If you choose to invest with or without seeking advice from such an advisor or entity, then any consequences resulting from your investments are your sole responsibility. Reading and using this newsletter or using our content on the web/server, you are indicating your consent and agreement to our disclaimer. The information contained herein has been obtained from sources believed to be reliable but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice and are for entertainment purposes only, no advice has been presented and no recommendation have been made. All information on TheGlobalMacroTrader.com, and any associated pages such as the SubStack pages, are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings along with discussion over chart formations and quantitative metrics may be mentioned but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security—including commodities, currencies, stocks, bonds, exchange traded funds (ETF), exchange traded notes (ETN), mutual funds, futures contracts, or any similar instruments. All text, images, ideas and concepts on TheGlobalMacroTrader.com and associated websites, emails, posts and social media messages constitute valuable intellectual property. No material from any part of TheGlobalMacroTrader.com and associated websites, emails, posts and messages may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of TheGlobalMacroTrader.com. All unauthorized reproduction or other use of material from TheGlobalMacroTrader.com and associated websites, pages and emails shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. The recipient should check any email and any attachments for the presence of viruses. TheGlobalMacroTrader.com accepts no liability for any damage caused by any virus transmitted by this company’s website, emails, attachments, posts and any other method of communication. TheGlobalMacroTrader.com expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. TheGlobalMacroTrader.com reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

Great review of the recent data and context on Fed cycles. If you see the Fed holding in March and the 10 year yield hovering around 4%, does that mean you don't see the last two cycles as very helpful models for the current one? Because in those, once the cuts started they were aggressive and the 10 year followed sharply.

On US equities, I particularly liked your take on watching the price action Friday mid-day to inform on momentum. To clarify, the strong rebound you speak of was the one from all day Thursday or just Friday morning?